Core View

Over the past week (December 1 to 8), the domestic ABS market continued the weak trend seen since November, with prices generally declining. Despite firmer prices of the upstream feedstock styrene, sluggish terminal demand and persistent supply pressure strongly suppressed the market, preventing cost-driven benefits from effectively transmitting to the spot market. Structural divergence has emerged within the market, with some mid-to-high-end grades showing relative resilience. In the short term, without substantial demand support, the market is expected to remain weak and range-bound.

I. Spot Price Trend: Internal Divergence Amidst a Broad Decline

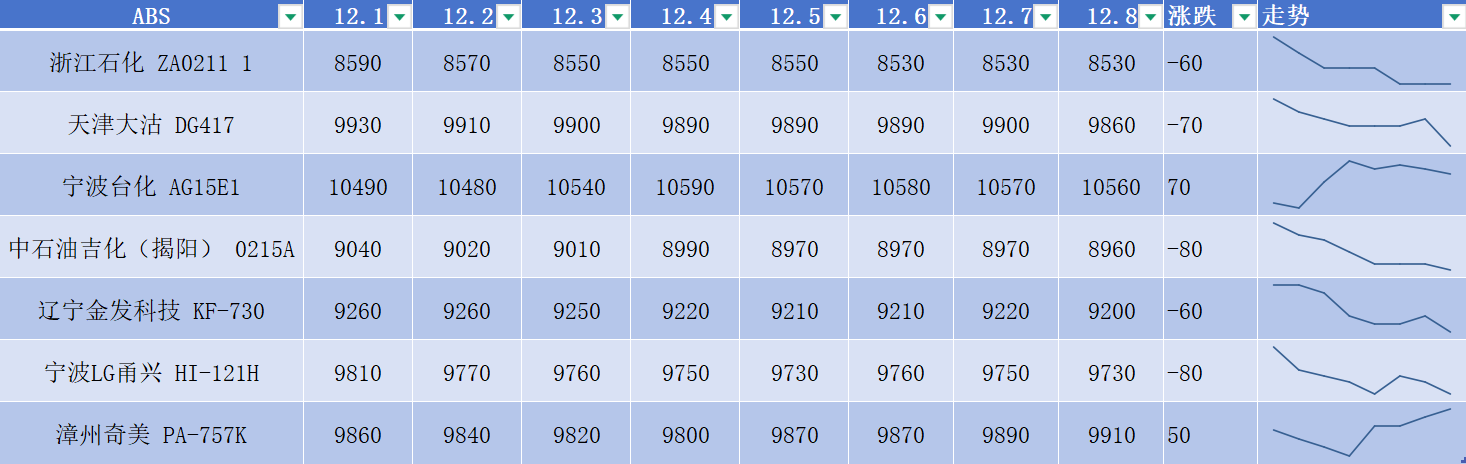

Monitoring of major ABS spot prices during the observation period shows a predominantly downward trend for mainstream grades, with only a few experiencing minor fluctuations. Specific data is shown in the table below:

Data Interpretation:

1.Overall Weakness: Among the seven main grades tracked, five saw price drops, indicating a dominant bearish sentiment. This aligns with the trend noted in recent industry reports that "rising feedstock failed to lift spot prices, which moved lower this week".

2.Emerging Divergence: The decline was not uniform. Some mid-to-high-end general-purpose grades, such as Zhangzhou Chi Mei's PA-757K and Ningbo Formosa's AG15E1, demonstrated notable resilience due to their stable customer base and relatively inelastic application demand.

3.Bottom Testing: Low-end general-purpose grades like Zhejiang Petrochemical's ZA0211 have fallen to and consolidated at low levels, suggesting sellers' reluctance to reduce prices further and the market is probing for a near-term floor.

II. Market Dynamics and Logic: Why "Feedstock Up, ABS Down"?

The core market contradiction lies in the intense clash between "rising costs" and "weak demand coupled with increasing supply," with the latter currently prevailing.

1.Core Pressure: Sluggish Terminal Demand Dampens Sentiment

December is a traditional production off-season. Key downstream sectors like home appliances, toys, and electronic components report lukewarm new orders. Market inquiries are weak, and pessimism prevails. Factories predominantly maintain a "hand-to-mouth" purchasing strategy, strongly resisting high-priced materials. This lack of solid order support makes any price increase unsustainable.

2.Supply Pressure: High Output and Inventories Weigh on the Market

The supply side offers no relief. Despite losses, major producers maintain high operating rates, caught in a dilemma to ensure cash flow and market share. Industry inventories remain elevated. To manage cash flow, producers and traders are forced to offer discounts, accelerating the price decline.

3.Failed Cost Transmission: Styrene Gains Cannot Salvage ABS

Notably, upstream styrene monomer (SM) prices have shown strength recently. Typically, this would provide solid cost support for ABS. However, in the face of extremely weak demand and high inventory pressure, this positive cost factor has been diluted and ineffective.

III. Outlook and Risk Warnings

In summary, the ABS market is in the early stages of "bottom consolidation with diverging rebounds."

Short-term Forecast (Next 1-2 weeks): The market is expected to continue a pattern of "weak fluctuation with individual breakouts." Low-end general-purpose grades have limited room for further significant declines, likely moving sideways. The divergent trend among mid-to-high-end grades may continue, serving as a bellwether for micro-shifts in market sentiment. A sustained price increase in leading grades with a noticeable expansion in trading volume could signal a broader market stabilization. Otherwise, range-bound fluctuation is likely.

Key Watch Points:

1.Demand Verification: Monitor for any concentrated pre-holiday (e.g., Chinese New Year) restocking demand from major downstream industries, a key potential variable to break the current stalemate.

2.Supply Adjustment: Observe whether major producers will initiate large-scale maintenance shutdowns due to sustained losses to alleviate supply pressure at the source.

3.Cost Sustainability: Track if the uptrend in styrene prices can persist. A sustained rise will eventually transmit to ABS production costs, providing foundational support.

Conclusion: For buyers, current prices are near a two-year low, opening a window for strategic inventory building. Priority attention can be given to stabilized or rebounding grades like Zhangzhou Chi Mei PA-757K and Ningbo Formosa AG15E1. For sellers, it's crucial to acknowledge the reality of high inventories and weak demand, adjusting sales strategies flexibly to prioritize cash flow. For all parties, the core contradiction remains the race between "cost-pushed increases" and "actual terminal demand." Close attention to the pre-holiday restocking dynamics in downstream sectors like home appliances is essential.

Note: Originally published by PLAS